Demand for biomass is only expected to grow in the coming years, be it for biomaterials or bioenergy, while there is only so much biomass that can be produced sustainably, says John Bell, who points to a looming 'availability gap'.

John Bell is ‘Healthy Planet’ Director at the European Commission’s DG Research & Innovation. In his position, he leads the Commission’s policy transitions on Climate Change, Bioeconomy, Food Systems, Environment, Biodiversity, Water, Circular Economy, Oceans and the European Green Deal. He is also the Chairman of the CBE JU Governing Board.

He responded in writing to questions from EURACTIV.

Highlights

- In ten years, the EU’s bioeconomy strategy has evolved from a research-driven policy to a framework designed to speed up the transformation to a climate-neutral economy that no longer relies on fossil fuels.

- There are currently 803 biorefineries in the EU, of which 363 produce liquid biofuels and 177 are integrated biorefineries that combine the production of bio-based products and energy.

- Demand for biomass is only going to increase, be it for biomaterials or bioenergy, while there is only so much biomass that can be produced sustainably.

- This highlights a potential ‘biomass availability gap’ between the potential demand for biomass and its sustainable supply, which can be as big as 40-70%.

- Only advanced biofuels should be prioritised as first-generation biofuels create direct competition with food crops for human consumption.

- Technological solutions alone won’t be sufficient to guarantee the environmental integrity of biomass. Therefore, measures will also be needed to make consumption patterns more sustainable, including changes in dietary habits.

- The removal of subsidies from the least efficient use of biomass and the creation of a functioning market for bio-based products should in itself redirect biomass use along the so-called ‘cascading principle’.

The European Commission published a progress report on the EU’s bioeconomy strategy on 9 June. What are the main achievements since the first strategy was launched in 2012? And what did the Commission learn in those ten years about the potential and limitations of the bioeconomy?

Indeed, the EU’s bioeconomy strategy is now 10 years old. And through that time it has gone through significant developments: while it started as a ‘knowledge-based’ bioeconomy, focusing on Research and Innovation and improving the efficiency in the use of renewable resources, it has evolved with the updated Bioeconomy Strategy adopted in 2018 to a policy framework to speed up – and in a certain way make possible – the transformation to a climate-neutral economy that no longer relies on fossil fuels and other unsustainable non-renewable resources.

Achieving a climate-positive effect through the substitution of harmful products and through the storage of carbon in bio-based products has been the focus, though the holistic character of the bioeconomy policy was also emphasised: looking at social, economic, and environmental sustainability aspects.

Another focus was the cooperation with countries and regions to support the development of bioeconomy strategies. This is one of the big successes: today, we have 10 Member states with dedicated bioeconomy strategies at the national level in the EU-27 (AT, DE, ES, FI, FR, IE, IT, LV, NL, PT) and 7 Member States in the process of developing their respective dedicated national strategies (CZ, HR, HU, LT, PL, SK, SE). We have also made substantial progress in macro-regions such as the BIOEAST Initiative countries, and 68 EU regions have already adopted policies where bioeconomy is a key element.

We have learned tremendously about the potential of bioeconomy solutions – there is virtually nothing that could not be substituted by bio-based processes or products. And we have accumulated precious knowledge about how bioeconomy works, how it can be measured, how win-wins are possible, and how to make it more a ‘norm’ than a ‘niche’ across our societies.

Are there new products now available to European consumers which didn’t exist ten years ago? Or are we still talking mainly about research and innovation projects?

Indeed, we saw that the progress in the last ten year was enormous, both thanks to unprecedented scientific advances, but also thanks to policy focus.

For instance, sustainable and innovative biorefineries today are turning food waste into useful and safe ingredients for food, feed and fertilisers with insects. We can upcycle biological waste or plastic waste with enzymes and other smart technologies. Seaweed cultivation does not require land, fertilisers and freshwater to produce low-carbon and high-nutritional value food and non-food products.

We see an increasing number of novel food applications and Europe’s global market share for bio-based chemicals and materials was about 31% which is twice the fossil-based sectors (16 %).

So, progress has been huge, and the EU has given significant support. For example, the Bio-based Industries Joint Undertaking (BBI JU) was a partnership between the European Commission and the Bio-based Industry Consortium.

The main aim of the partnership was in particular to demonstrate technologies that enable new chemical building blocks, new materials and consumer products from European biomass, which replace the need for fossil-based inputs. The objective of BBI JU and of its members was to contribute to the development of sustainable and competitive bio-based industries in Europe, based on advanced biorefineries that source their biomass sustainably. And we are on a similar track for its successor, the Circular Bio-Based Europe Joint Undertaking (CBE JU) which is already in full motion. This partnership will run until 2027 and will dedicate €2 billion to fund projects advancing competitive circular bio-based industries. It has just very successfully closed its first call for projects, with an indicative budget of €120 million.

The CBE JU expects creation of 152 new bio-based products by 2024.

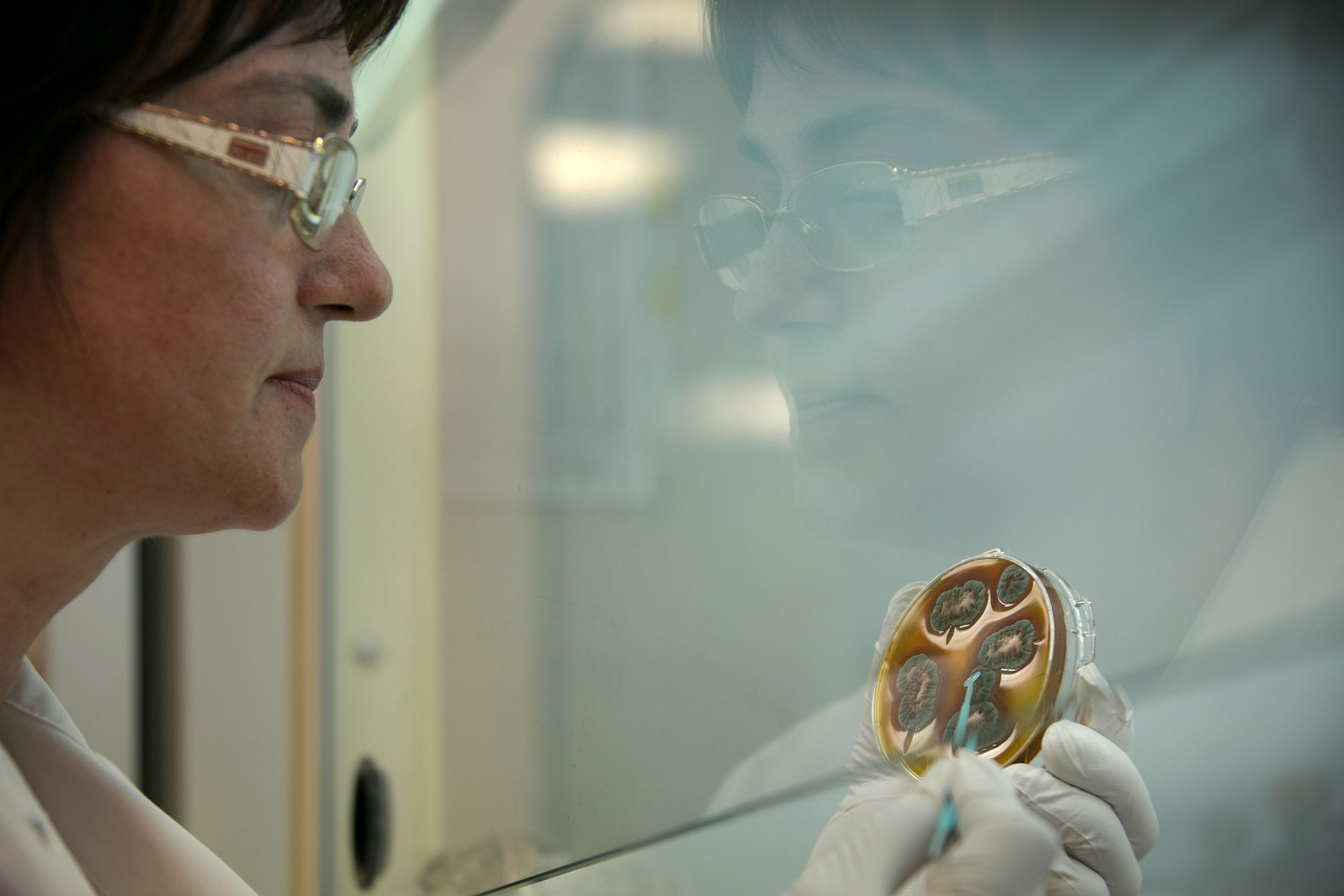

John Bell, Healthy Planet Director at the European Commission’s DG Research & Innovation

Regarding new bio-based consumer products such as cosmetics, food applications, automotive parts, fertilisers or adhesives, the CBE JU reported the expected creation of 152 such products by 2024.

Packaging constitutes one of the main applications delivered by CBE JU projects which bring new bio-based plastics, composites and films, lacquers and coatings, as well as bio-based adhesives to bond materials for multi-layer packaging applications. BIOBARR and Refucoat are examples of projects which are preparing functionalised 100% bio-based materials for packaging with antimicrobial and antioxidant activity or improved mechanical and barrier properties.

New bio-based consumer products (such as cosmetics, food applications, automotive parts, fertilisers, adhesives, etc.) are expected to be more sustainable than current fossil-based alternatives. This can be achieved by improved material efficiency, reduced GHG emissions, higher biodegradability, recyclability or other effects during use or reuse.

Moreover, the bio-based ‘consumer products’ have to meet clear market demand and fulfil specific technical requirements, be economically viable and match all relevant sustainability criteria.

Examples of new consumer products developed by CBE JU include:

- Reported by project ALEHOOP, which aims to produce animal feed, food additives and nutritional products such as healthy snack bars, sports drinks or meat analogues/veggie products through the upcycling of low-cost proteins recovered from macroalgal and vegetal residues.

- Reported by project DEEP PURPLE, which targets the production of a range of bio-based products including encapsulated fertilisers, biodegradable bio-based plastics, self-repairing construction materials and cosmetics products. The project will valorise diluted urban biowastes using Purple Phototrophic Bacteria (PPB).

- In the search for durable materials, the ECOXY project developed fibre-reinforced thermoset composites which are repairable and reshapable in addition to being recyclable (3R). The BARBARA project developed prototypes for the automotive and construction industries with advanced thermomechanical properties by incorporating extracted biopolymers into bio-based plastic.

How many biorefinieries are currently in operation across the EU? How many of them can be considered to be operating at an industrial scale? And how many does the Commission believe should be in place by 2030 and 2050?

The answer to this important question depends on precise definitions and criteria. To start, biorefineries may have different sizes, use very different biological feedstocks and may produce different end-products or intermediates, so all those factors should be considered.

The 2018 Research brief developed by the European Commission JRC Biorefineries distribution in the EU identified as many as 803 biorefineries in the EU, of which 507 produce bio-based chemicals, 363 liquid biofuels and 141 bio-based composites and fibres (multi-product facilities are counted more than once). Of those facilities, 177 are reported as integrated biorefineries that combine the production of bio-based products and energy.

More recently, the European Commission contracted a study EU Biorefinery Outlook to 2030, which was published in May 2021. It was developed specifically in support of the EU Bioeconomy Strategy’s action to facilitate the development and deployment of new sustainable biorefineries and to estimate the potential deployment of different types of biorefineries. As background, the Bioeconomy Strategy states the goal of developing 300 new sustainable biorefineries by 2030.

The focus of the Biorefinery Outlook study was specifically on chemical and material-driven biorefineries which include the production of innovative high-value bio-based products. This includes integrated biorefineries that produce chemicals and materials as major products, but could also co-produce food and feed as well as bioenergy. The study excluded bioenergy and biofuel biorefineries, and conventional biomass processing facilities focused on traditional bio-based products, such as paper and board. Applying such criteria, around 300 chemical and material-driven biorefineries at commercial or demonstration scale have been identified in the EU

Two scenarios for 2030 for the demand for bio-based chemicals and materials in the EU have been developed. The high growth scenario assumes a favourable macro-economic environment and policy for bio-based products, including a strong recovery from the Covid-19 pandemic, a high oil price (increasing the competitiveness of bio-based products in some applications), a market pull policy put in place for bio-based chemicals and materials and widespread financial support for various types of biorefinery investments.

The study revealed that the potential demand in 2030 could grow significantly in the high growth scenario to ~16 million tonnes per year (Mtpa) growing at about 9.9% per year until 2030, but could reach approximately only half this amount in the low growth scenario growing at about 3.0% per year.

The current bio-based chemicals and materials supply from EU biorefineries is estimated at 4.6 million tonnes. It is estimated that supply from new or expanded biorefineries could grow by an additional 3.1 million tonnes in the EU in 2030 in the high growth scenario, whilst in the low growth scenario, this could be limited to an additional 1.1 million tonnes.

The above-mentioned assumptions underscore, yet again, the sustainable supply of biomass as one of the critical issues for bioeconomy, and suggests that further policy and research efforts may be needed to address the expected ‘biomass availability gap’, taking into account the trade-offs and ecological limits related to supply of biomass and its various uses.

To conclude, it is difficult to give a concrete ‘desired’ number of necessary biorefineries in the EU. We should keep in mind that just looking at the number of biorefineries does not give a full picture, as what matters is also the resource efficiency (a smaller number of more efficient plants may be sufficient). In the current EU Horizon Europe Framework Programme (2021-2027) significant budget is available to tackle biorefinery-related technical barriers, including resource efficiency, and full use of biomass, such as for example within Pillar 2 “Global Challenges and European Industrial Competitiveness” – Cluster 6 “Food, Bioeconomy, Natural Resources, Agriculture and Environment”.

Also, CBE JU has funded 13 large-scale (flagship) projects, and many demonstration projects, developing various biorefinery solutions. The European partnership will continue supporting such biorefinery technology development, demonstration and market introduction.

The report also highlighted the existence of “trade-offs” between competing uses of land, sea and biomass. Can you outline the main trade-offs? Can these trade-offs be overcome or do they also draw the limits of the bioeconomy’s potential?

The 2018 Bioeconomy Strategy already recognised the underlying need for the bioeconomy to respect environmental boundaries.

One of the most obvious areas where these limits are or will be manifesting is the issue of land availability to produce sufficient quantities of biomass for various uses while meeting all the other crucial policy objectives such as biodiversity protection, zero pollution and maintaining our land and ocean carbon sink.

Various projections are informing us that demand for biomass is only going to be increasing, be it for biomaterials or bioenergy. On the other hand, there is only so much sustainable increase in biomass production that we can achieve through innovative agronomic and forestry techniques without exacerbating existing problems linked to intensive land management such as soil erosion, loss of biodiversity or nutrient pollution.

Studies suggest that the gap between the potential demand for biomass and its sustainable supply can be as big as 40-70%. This is a real issue that can only be addressed through a holistic approach.

Several principles can help with reducing the demand and consumption on the one hand, but also increase resource efficiency through the application of the cascading principle, which ensures that biomass stays in the system for as long as possible by prioritising long-term material uses over energy uses wherever possible.

John Bell, Healthy Planet Director at the European Commission’s DG Research & Innovation

Sustainable bioeconomy policy can provide exactly that type of framework for thinking about these issues. Several principles can help with reducing the demand and consumption on the one hand (for example, reducing food loss, sustainable consumer practices, etc.), but also increase resource efficiency through the application of the cascading principle, which ensures that biomass stays in the system for as long as possible by prioritising long-term material uses over energy uses wherever possible.

On the other hand, sustainable supply and ecological co-benefits can be increased through management practices such as agroforestry or using adapted crop varieties. The main use of biomass is for food, and here predominantly for feed.

Dietary habit changes would greatly help in this transition as this would free up large areas of land currently used for the production of animal feed – this land could instead be used for land restoration purposes or for cultivation of industrial crops, or recreation purposes (agro-tourism, reforestation, etc.).

The Commission is currently launching activities together with the Joint Research Centre on the Integrated bioeconomy assessment of land and biomass use that will shed light on exactly these types of trade-offs and possible policies and management practices that could alleviate them.

In its progress report, the European Commission highlighted the renewed importance of the bioeconomy to ensure Europe’s energy independence and food security in the context of the Ukraine war. What are the biggest opportunities which haven’t yet been exploited in these two areas?

There is a clear opportunity to alleviate the immediate shortages of imported gas and fuels and high electricity prices in the short term by ramping up the supply of domestically produced bioenergy.

This can take the form of biomethane, whose production is planned to be significantly increased as outlined in our RePowerEU Communication. Forest bioenergy, if obtained under sustainable management practices, can moreover reduce our reliance on imported coal.

With biofuels, the approach is more complicated as the first-generation biofuels create direct competition with food crops for human consumption, and ensuring food security is an objective that should always take precedence.

Only advanced biofuels should be prioritised.

John Bell, Healthy Planet Director at the European Commission’s DG Research & Innovation

For this reason, only advanced biofuels should be prioritised. Needless to say that any increase in bioenergy production has to be in line with the sustainability criteria defined in the Renewable Energy Directive.

On the other hand, this temporary increase in bioenergy production has to eventually be aligned with the resource efficiency principles I outlined previously and, in the medium and long term, bioenergy should be restricted to areas where no other alternatives are economically or technologically feasible.

There are furthermore other interlinkages between bioeconomy and food and energy security, such as the role of bio-based fertilisers and bio-pesticides, some of which we have supported through our bio-based partnerships. These products can contribute to increasing sustainable supplies of biomass in a time when prices of fertilisers are prohibitively high.

A recurring issue seems to be scale: whether looking at biofuels, bioenergy, or bio-based plastics, it seems any attempt to reach the industrial scale is confronted with ecological limitations. Does this mean the bioeconomy is bound to remain a niche?

While we are certainly aware of the ecological limitations, it has to be understood that in order to bring down fossil emissions drastically, all the sectors that currently rely on fossil energy and fossil fuels as feedstock will eventually have to replace these, and bio-based applications will often be part of the solution.

The bioeconomy has a great potential to provide the much-needed answer for the industrial transformation of certain sectors such as the chemical sector while fully respecting the ecological boundaries.

John Bell, Healthy Planet Director at the European Commission’s DG Research & Innovation

If we handle the demand for biomass sensibly on the policy side and we ensure high circularity and resource efficiency of the biological resources, the bioeconomy has a great potential to provide the much-needed answer for the industrial transformation of certain sectors such as the chemical sector while fully respecting the ecological boundaries.

In the progress report, we found that technological solutions alone won’t be sufficient to guarantee environmental integrity. Therefore, we also need to make consumption patterns more sustainable. That regards the diets mentioned already, but also other bio-based value chains. New business models must concentrate on added value rather than the number of products.

Furthermore, those sectors that rely on fossil carbon as their feedstock will obviously need to find also other sources of non-fossil carbon, such as carbon captured from industrial processes or carbon retrieved through the recycling of current fossil-based products.

How can the cascading use of biomass be translated into policy while avoiding over-regulation and bureaucracy?

There are several ways to achieve this. With last year’s proposal for the revision of the Renewable Energy Directive, the Commission is trying to create a framework with some rules that will at least prevent perverse financial incentives for burning of such forest biomass whose quality would justify its use elsewhere. Such subsidies tend to distort the feedstock market and risk putting bio-based industries at a disadvantage vis-à-vis bioenergy operators.

It is of course in the interest of Member States to use their biological resources efficiently and therefore most regulation, and policy incentives should happen on their level.

As the first step, supporting capital investments in regions to build robust bio-based supply chains that can actually turn this biomass into useful bio-based products with a high added value is crucial. Without it, turning biomass into energy will remain the only feasible option for many countries and regions.

Removal of subsidies from the least efficient use of biomass and the creation of a functioning market for bio-based products should in itself redirect biomass use along the cascading principle.

By EURACTIV Senior Energy & Environment Editor Frédéric Simon.